10+

Years of Experience

25+

Year Warranties

40+

5 Star Reviews

Top Services We Offer

We offer the most affordable packages in the industry. Let the experts take care of you.

Commercial Installation

Our team has designed thousands of home solar systems to maximize our customer's savings!

Panel Warranties

Our partners back everything they provide with several different warranties. Most up to 25 years!

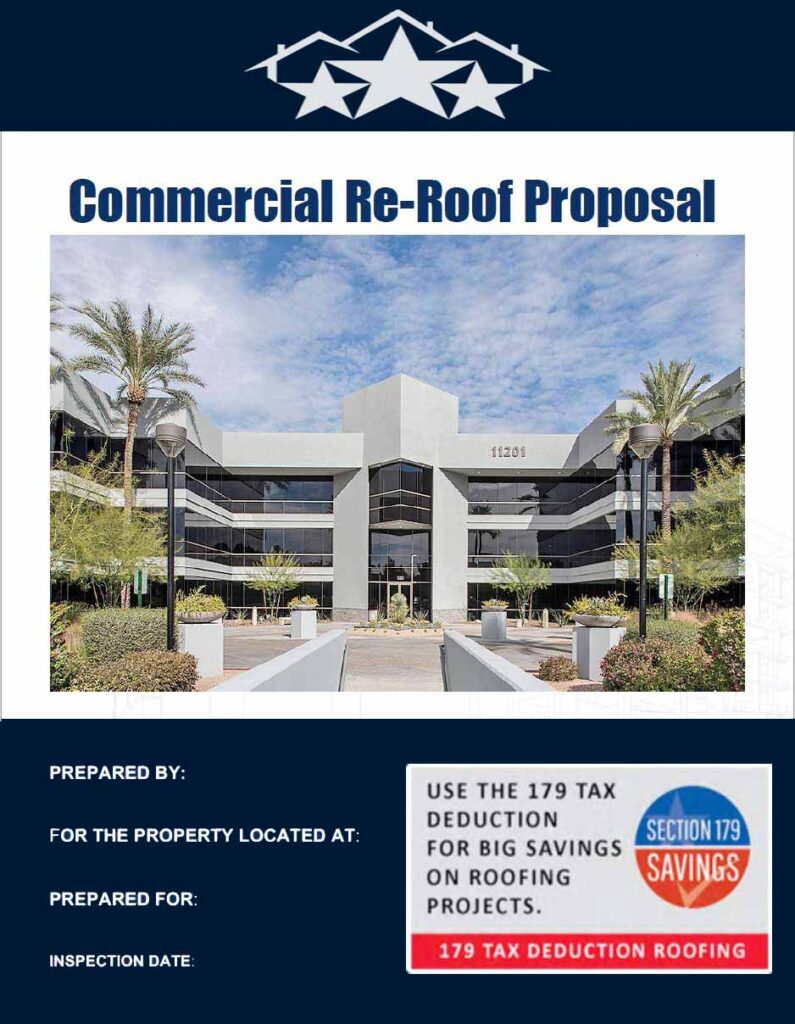

Tax Savings Proposals

Our commercial roof proposal includes the benefits and savings that are included from using Section 179D!

Take Advantage of Section 179D

179D is a popular tax incentive that provides building owners and eligible designers/builders the opportunity to claim a tax deduction of up to $1.80 per square foot for installing qualifying energy efficient systems and buildings.

Tenants may be eligible if they make the construction expenditures.

More about Section 179

Commercial Building Owners can deduct the full cost of a roof replacement up to 1M dollars the year it’s completed using the Section 179 Tax Deduction.

What Can Qualify for 179 Tax Deduction?

RETAIL BUILDINGS

OFFICE BUILDINGS

INDUSTRIAL BUILDINGS

APARTMENT BUILDINGS

These are just some examples, not all of them. Commercial Building Owners can write off up to 1M dollars of their Re-Roof project even if they do not pay for it! Meaning it was paid for by the insurance carrier and/or a commercial funding company. That’s a huge tax deduction!!

But it gets even better!

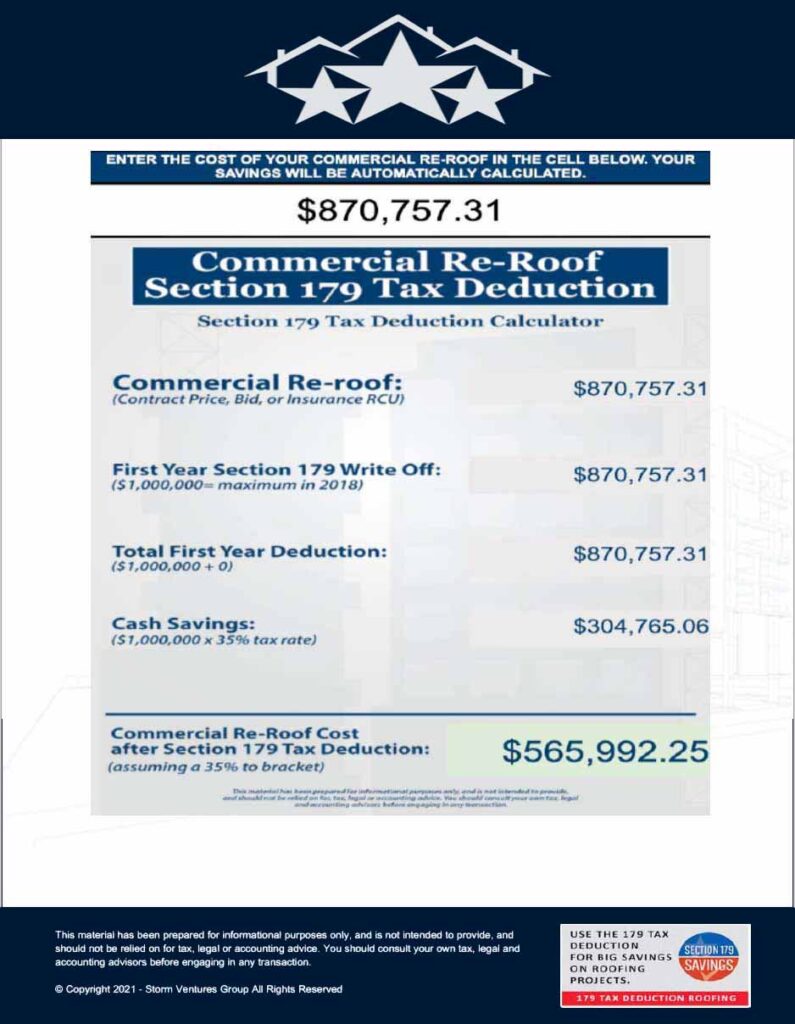

There is also a 179D tax deduction available to commercial building owners that make eligible energy-efficient improvements (aka Solar Panel Installation) to their commercial buildings, which can allows them to deduct up to $1.80 SF, approximately half of their Solar installation in Year One.

What Can Qualify for 179D Tax Deduction?

UNIVERSITIES

LIBRARIES

CITY PARKS

K-12 SCHOOLS

This change is significant

Together these two tax deductions combine to make one of the best available Tax Strategies ever created in U.S. History for Commercial Building Owners.

However, many today are unaware that Section 179 applies to Commercial Re-Roofing. This is a HUGE OPPORTUNITY for Roofing Contractors selling Commercial Building Owners whom can provide this as part of their commercial roof proposal.